Boeing forecasts strong aviation growth in India owing to the country’s growing economy and an expanding middle class, fueling demand for more than 2,200 new jets valued at nearly $320 billion over the next 20 years.

Boeing shared its India forecast on Wednesday as part of its annual Commercial Market Outlook (CMO), which anticipates resilient long-term demand for commercial airplanes and services.

Although the COVID-19 pandemic sharply reduced Indian air travel last year, the country’s domestic passenger traffic is recovering more rapidly than in most other countries and regions, recently reaching 76% of pre-pandemic levels.

While COVID-19 remains a near-term challenge, the country’s passenger traffic is forecast to outpace global growth, doubling from pre-pandemic levels by 2030, according to the CMO.

India’s passenger market is the world’s third-largest and its economy is predicted to grow at 5% annually through the forecast period, the highest of any emerging market.

“Many more Indians will travel by airplane for leisure and business as incomes rise tied to industrialization and an economic growth rate in South Asia that leads all emerging markets,” said David Schulte, managing director of Regional Marketing, Boeing Commercial Airplanes. “With greater demand for domestic, regional and long-haul travel, we anticipate India’s commercial fleet will grow four-fold by 2039.”

Indian carriers have opportunities for growth in international markets, according to the Boeing forecast. Several airlines have started or plan to start non-stop routes between India and North America to serve a passenger preference for direct service flights, Schulte said.

“India’s burgeoning manufacturing and services business means the region is uniquely positioned to become a major aerospace hub,” said Salil Gupte, president of Boeing India. “We remain committed to partnering across India to develop the nation’s aerospace ecosystem, as continued investment in the civil aviation infrastructure and talent will enable sustained growth.”

Another interesting insight from Boeing’s market forecast is that single-aisle airplanes in India that are mostly short-haul flights within the country and from India to Asia-Pacific and Middle Eastern countries will continue to serve growth. Thus, Indian operators will require 1,960 new single-aisle airplanes over the next 20 years.

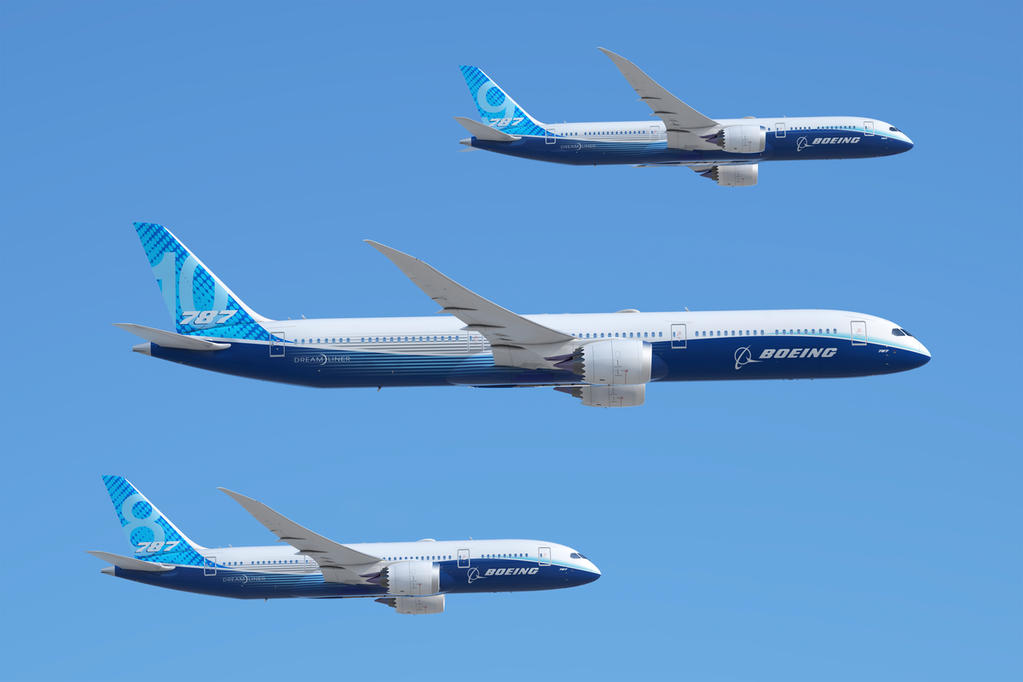

Boeing forecasts a 20-year market for 260 new widebody airplanes such as the 787 Dreamliner which is an increasingly popular model in India, to meet long-term demand for long-haul connectivity, especially to North America and Europe.

The growth of Indian air cargo is projected to average 6.3% annually over the next 20 years, the major driving force being India’s manufacturing and e-commerce sectors. This number which is above the global-average cargo traffic growth is expected to get support from the “Make in India” initiative in the Indian domestic market.

In addition to this, with a growing number of women choosing to pursue aviation careers, India’s civil aviation industry will require nearly 90,000 new pilots, technicians, and cabin crew personnel during the 20-year forecast period.

Globally, Boeing projects the demands for aftermarket services to be equivalent to $9 trillion over the next two decades and the need for 43,110 new commercial airplanes.

Follow EurAsian Times on Google News