On July 8, China started constructing the Kela photovoltaic power station, a crucial component of the hydro-solar hybrid power station in southwest China with the highest installed capacity in the world, state-run CGTN reported.

Kela photovoltaic power station is located in Yajiang County, Tibetan Autonomous Prefecture in Garze, Sichuan Province. According to the report, it is expected to have a total installed capacity of one million kilowatts.

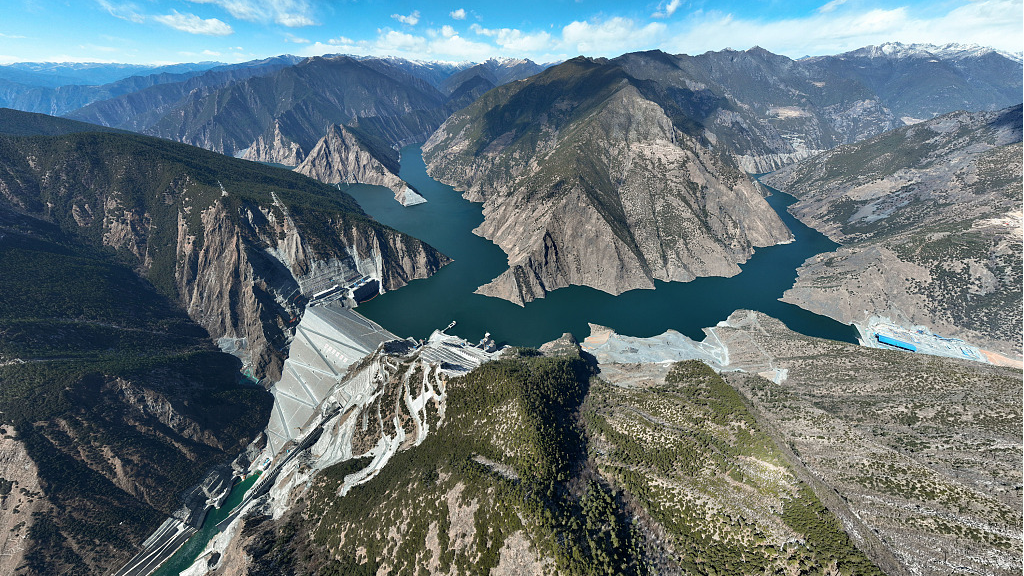

It will eventually connect to the three million kilowatt Lianghekou hydropower plant, the world’s largest hydro-solar hybrid power station, which began operating in March.

The report noted that the power generation of photovoltaic power stations varies daily and in weather conditions since they rely on sunlight to produce electricity.

For the power grid to produce reliable, high-quality, clean electricity, the hydropower component aids in regulating any instabilities in the photovoltaic power supply.

The station, scheduled to open next year, will have a footprint of about 16 square kilometers, or 80 of Beijing’s “Bird’s Nest” National Stadiums.

The power plant will reduce carbon dioxide emissions by more than 1.6 million tons and produce 2 billion kilowatt-hours (kWh) of clean electricity each year, comparable to more than 600,000 tons of standard coal, said Qi Ningchun, chairman of the Yalong River Hydropower Development Co. Ltd.

The Longyangxia hydro-solar power station, recognized by the Guinness World Records on June 26, is the highest capacity hydro-solar power station currently in use.

It is situated in China’s northwest Qinghai Province and has a total generation capacity of 2.13 million kilowatts, including 1.28 million kilowatts of hydropower and 850,000 kilowatts of solar power.

China’s Dominance in Solar Power Market

The International Energy Agency recently warned that China’s dominance of the world’s solar panel markets had created a weak supply chain that risks becoming overly dependent on the nation.

The IEA report published on July 7 states that over the past ten years, the manufacturing capacity for solar panels has increasingly moved from Europe, Japan, and the United States to China.

According to the report, China now commands a market share of more than 80% for all phases of solar panel manufacturing, doubling its share of global demand.

The report further stated that the country’s industrial policy, which views the manufacturing of solar panels as a strategic industry and places a strong emphasis on boosting domestic demand, is the source of that dominance.

China exported more than $30 billion of solar photovoltaic (PV) products in 2021, making up nearly 7% of its five-year trade surplus.

PV products and materials convert sunlight into electricity. Global trade in solar PV products increased by more than 70% from 2021 to more than $40 billion.

In a webinar on the report, Executive Director Fatih Birol said, “the world should be thankful to China” for driving down the cost of solar PV by more than 80% in the past ten years. The IEA lauded China’s panel market advancement as helping boost global solar power uptake.

However, the report noted that through 2025, the production of solar panels will “almost completely rely on China.” The IEA predicted that China would soon account for nearly 95% of global manufacturing output.

The country’s northwest Xinjiang region alone produces 40% of the world’s polysilicon supply, a crucial component in solar panel production.

Some nations have raised concerns about China’s dominance of solar panel supply chains due to claims of trade and human rights violations.

Over the last few years, Xinjiang has become a significant focus for international condemnation of China’s government for accusations of human rights violations against Muslim Uyghurs in the region.

Last year, US president Joe Biden prohibited imports of Xinjiang’s solar panel components. In response, China has threatened retaliatory action and refuted the allegations. The IEA report made no mention of human rights violations in Xinjiang.

Meanwhile, according to the IEA, the demand for minerals will probably increase significantly as the world moves toward net-zero emissions by 2050. Such quick expansion might lead to more supply-demand imbalances, which would raise prices and cause supply shortages.

Nevertheless, overcoming China’s cost competitiveness as a manufacturer is a significant challenge. All solar panel supply chain components are produced there for 10% less than in India, beating out the United States and Europe by 20% and 35%, respectively.

- Contact the author at ashishmichel@gmail.com

- Follow EurAsian Times on Google News