India has announced plans to support the construction of up to 50 small nuclear reactors (SMRs) through public-private partnerships. This development marks India’s entry into the global race for SMR technology, joining countries like the United States, Russia, and China.

In a groundbreaking move, the Nuclear Power Corporation of India (NPCIL), a public sector enterprise under the Department of Atomic Energy, will construct, manage and operate 220 MW for private players.

These private entities will provide the funding and land for the project. This shift, reported by PTI and attributed to a senior government official, marks the first time nuclear power—previously under exclusive government control—will be accessible to private companies for commercial use.

India’s primary aim is to deploy a large fleet of small nuclear reactors to power hard-to-decarbonize industries like steel and cement. Additionally, power companies and data centers in India stand to gain significantly from this development.

The Global Landscape Of SMR Development

Nuclear power was initially developed in the quest for materials necessary for nuclear weapons during and after World War II. Despite significant technological advancements, the fundamental process of nuclear power generation remains largely unchanged.

Today, Small Modular Reactors (SMRs) are being developed worldwide, with both public and private institutions actively working to bring SMR technology to market within this decade.

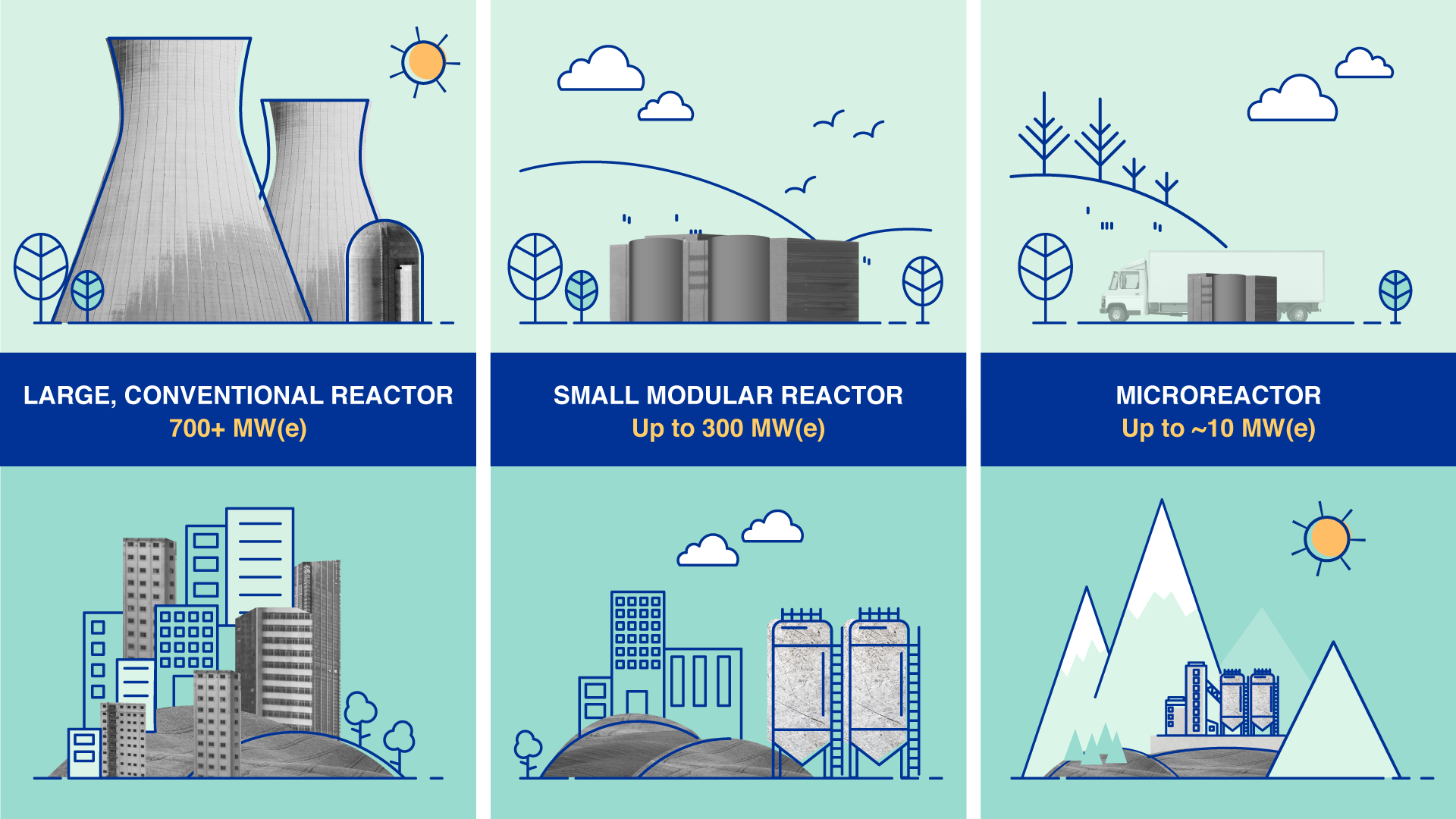

Small modular reactors (SMRs) are advanced nuclear reactors with a power capacity of up to 300 MW(e) per unit, roughly one-third the generating capacity of traditional nuclear power plants. The benefits of SMRs are closely tied to their compact and modular design. Due to their smaller footprint, SMRs can be installed in locations unsuitable for larger nuclear facilities.

According to the International Atomic Energy Agency (IAEA), over 80 commercial SMR designs are currently in development globally. These designs target a range of outputs and applications, including electricity generation, hybrid energy systems, heating, water desalination, and steam production for industrial uses.

At present, various SMRs are either under construction or in the licensing phase in the United States, China, Russia, the UK, Canada, Argentina, South Korea, and even Ghana, which is now exploring this technology.

According to the Nuclear Energy Agency, only three Small Modular Reactors (SMRs) are operational worldwide. Two are located in China and Russia, the US’s central geopolitical rivals, while a test reactor is also in operation in Japan.

United States: Long History

The United States has a long history with small nuclear reactors, dating back to 1955 when the first civilian SMR was commissioned in Elk River, Minnesota. This 22-MW reactor exceeded its budget by $9.8 million and operated for only three and a half years before cracks were discovered in its cooling system in February 1968.

In 2000, the Department of Energy funded a project at Oregon State University to explore a multi-application small light water reactor (SLR).

In 2007, the university granted NuScale exclusive rights to the design of the SMR and continued access to its test facility. In 2011, Fluor Corporation, a multinational engineering firm, invested in NuScale, and by 2018, the US Nuclear Regulatory Commission approved the first phase of design review.

Currently, one SMR design from NuScale has received approval from the Office of Nuclear Energy.

Despite these advancements, the industry has faced challenges. A NuScale project in Idaho was canceled in 2023 due to cost escalation. In response, the Department of Energy announced $900 million in funding to accelerate SMR deployment in June 2024.

Recent developments show promise for international collaboration, with an agreement reached at the US-Africa Nuclear Energy Summit to deploy a NuScale VOYGR-12 SMR plant in Ghana.

Russia: Floating Innovations

Russia has taken a unique approach to SMR technology with the Akademik Lomonosov, a 70 MW floating nuclear power plant in the Arctic Ocean. It is the world’s first and only floating nuclear power plant and began commercial operations in May 2020, providing electricity and heating to the Pevek region.

Rosatom, the State Atomic Energy Corporation, is placing significant emphasis on SMRs as a key element of Russia’s nuclear energy strategy through 2050. They have developed a diverse portfolio of designs, including the RITM series of reactors and Shelf-M reactors for off-grid installations.

Rosatom has created a diverse portfolio of designs for both domestic use and potential export, addressing a wide range of applications and market segments.

This includes the RITM series of reactors, with total capacities ranging from 50 to 600 MWe, Shelf-M reactors for off-grid installations with capacities between 10 MWe and 50 MWe, and the generation-IV SVBR-100, a lead-bismuth-cooled fast reactor.

The RITM series design draws on Soviet PWR technology initially developed for icebreaker vessels, boasting several hundred reactor years of operational experience.

China: Rapid Progress

China has made rapid progress in SMR development. In 2016, China announced plans to develop its own state-funded floating SMR design and has since developed several types of SMRs, including the HTR-200, ACP100, and other molten salt reactors.

As of March 2024, China has one commercially available SMR: ‘the Linglong One’ or ‘ACP100’. The main control room for this 125-megawatt reactor began operations in May 2024 in Hainan Province. It’s projected to produce 1 billion kilowatt-hours of energy annually. It was developed by the China National Nuclear Corporation and is owned by Hainan Nuclear Power Company.

The Linglong One is just one aspect of China’s expanding nuclear energy program, which is poised to surpass the United States in total nuclear power capacity within the next decade.

UK: Preparing For SMR Implementation

In the UK, universities like Imperial College London have operated small nuclear reactors for educational and training purposes for many years. Imperial’s reactor, located just outside London, was in operation from 1965 until 2010.

While there are currently no operational Small Modular Reactors (SMRs) in the UK, the government is in the process of selecting companies to develop the country’s first SMRs.

SMRs are a key focus in the UK nuclear industry, with at least four companies—GE-Hitachi, Holtec Britain, Rolls-Royce SMR, and Westinghouse Electric Co.—competing to have their designs approved by Great British Nuclear.

Additionally, US energy firm Westinghouse plans to construct four SMRs in northeast England, specifically in Tees Valley, near the existing Hartlepool nuclear power station.

Canada: Building For Future

Canada is currently constructing four small modular reactors (SMRs) at the Darlington site in Ontario. Commercial operations are expected to commence in 2028.

In March 2022, the provinces of Ontario, Saskatchewan, New Brunswick, and Alberta agreed on a joint strategic plan to advance the development of SMRs. In 2023, Canada launched the Enabling Small Modular Reactors Program, which provides funding for research and development projects related to SMRs.

This program supports projects requesting up to $5 million in funding, with Indigenous applicants potentially eligible for up to 100% funding.

Argentina: Prototypes

Argentina is in the process of constructing a small modular reactor (SMR) prototype known as CAREM25. In October of last year, the National Atomic Energy Commission and Nucleoeléctrica Argentina, a state-owned company, signed a framework agreement to provide technical assistance for the CAREM project.

Recently, El Salvador signed a memorandum of understanding with Argentina’s National Atomic Energy Commission to collaborate on developing its nuclear program.

South Korea: Long-Term Plans

South Korea currently has no operational small modular reactors (SMRs) but aims to introduce its first SMR by 2035. The country operates 26 nuclear reactors, with four additional units under construction.

This year, the government significantly increased the budget for developing and exporting innovative small modular reactors (I-SMRs) by more than ninefold, from approximately 7 billion won ($5.2 billion) in 2023 to about 65 billion won ($49 billion). The plan includes launching I-SMRs in the global market.

Potential Concerns & Future Outlook

While SMRs offer numerous benefits for clean energy production and could help countries address the Sustainable Development Goals (SDGs), there are concerns about their potential dual-use capabilities.

The possibility of using SMRs to produce materials for nuclear warheads and co-locating them with military sites raises non-proliferation concerns.

The increased use of renewable energy coupled with the introduction of SMRs has the potential to fill energy gaps and contribute to a cleaner, more sustainable future. However, careful consideration and international cooperation will be necessary to ensure that this technology is developed and deployed responsibly.

- Shubhangi Palve is a defense and aerospace journalist. Before joining the EurAsian Times, she worked for ET Prime. In this capacity, she focused on covering defense strategies and the defense sector from a financial perspective. She offers over 15 years of extensive experience in the media industry, spanning print, electronic, and online domains.

- Contact the author at shubhapalve (at) gmail.com